Beyond the Hype: A Practical Guide to Using the Fear and Greed Index

Advertisements

You’ve probably seen the headlines: “Fear and Greed Index Plunges to Extreme Fear” or “Market Euphoria Hits New High.” It’s a catchy gauge, often flashed during volatile times. But here’s the thing most articles won’t tell you: used naively, this index can lose you money just as fast as following a hot tip on social media.

I’ve traded through multiple cycles, and I’ve watched people get burned by misreading this tool. It’s not a magic buy-low, sell-high signal. It’s a psychological barometer. And like any barometer, you need to know how to read it, what its flaws are, and when to ignore it completely.

Let’s cut through the noise.

What You'll Learn in This Guide

- What the Fear and Greed Index Actually Measures (It's Not Just a Feeling)

- The 3 Most Common & Costly Mistakes Traders Make

- How to Actually Use the Fear and Greed Index in Your Trading

- Crypto Fear & Greed vs. Stock Market Fear & Greed: Key Differences

- Moving Beyond the Index: Building a Sentiment Toolkit

What the Fear and Greed Index Actually Measures (It's Not Just a Feeling)

The most popular version, from CNN and now maintained by Alternative.me, doesn't survey people's feelings. It derives sentiment from market behavior. Think of it as inferring the crowd's emotion from its actions, not its words.

For the stock market index, it looks at seven components:

The Guts of the Gauge

Stock Price Momentum: How the S&P 500 compares to its moving averages. Rising above = greed, falling below = fear.

Stock Price Strength: The number of stocks hitting 52-week highs vs. lows.

Market Volatility: The VIX index. High VIX = fear.

Put and Call Options: The ratio of bearish put options to bullish call options.

Safe Haven Demand: How stocks are performing versus Treasuries.

Junk Bond Demand: The spread between high-yield bonds and investment-grade bonds.

Market Breadth: The volume in rising stocks vs. falling stocks.

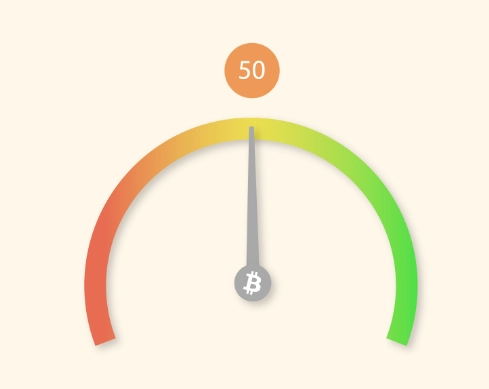

Each gets a score, they're averaged, and scaled from 0 (Extreme Fear) to 100 (Extreme Greed). The crypto version uses similar but different inputs like volatility, social media sentiment, and dominance.

The core idea is sound: markets are driven by human psychology. Greed pushes prices beyond fair value, fear crashes them below it.

The 3 Most Common & Costly Mistakes Traders Make

This is where experience talks. I've made some of these errors myself early on.

1. Treating It as a Timing Signal

The biggest trap. You see “Extreme Fear” and go all-in. The market drops another 20%. You're wiped out. The index isn't a timing tool; it's a context tool. It tells you the emotional temperature, not when the fever will break.

Markets can stay irrational longer than you can stay solvent. An index reading of 10 can go to 5.

2. Ignoring the Divergence

This is the subtle one. Let's say the S&P 500 makes a new high, but the Fear and Greed Index starts rolling over and fails to make a new high alongside it. That's a bearish divergence—the price is rising, but the underlying market behavior (breadth, momentum) is weakening. It's a warning sign that the rally is getting tired, even if the headline number looks greedy. Most people just look at the absolute number and miss this.

3. Using It in Isolation

A reading of “Extreme Greed” during a powerful, fundamental-driven bull market (like one fueled by massive tech earnings) is very different from “Extreme Greed” during a speculative bubble fueled by meme stocks. The index doesn't know the difference. You have to.

How to Actually Use the Fear and Greed Index in Your Trading

So how should you use it? Not as a traffic light, but as a weighting for your other analysis.

| Index Zone | Typical Market Mindset | Smart Action (Not Reaction) |

|---|---|---|

| 0-24: Extreme Fear | Panic. “Get me out at any price.” News is overwhelmingly negative. Capitulation. | Start scaling into high-quality positions you've researched. Don't go all-in. Increase your watchlist. This is a time for disciplined accumulation, not bravery. |

| 25-44: Fear | Worry. Uncertainty reigns. Investors are cautious, pulling money out. | Stay defensive, but prepare your buy list. Look for assets unfairly punished. This is often where the bulk of a downtrend plays out. |

| 45-55: Neutral | Indecision. The market is balanced, waiting for a catalyst. | The index gives you little edge here. Rely on your fundamental and technical analysis. Avoid making big bets based on sentiment alone. |

| 56-74: Greed | Optimism. Money is flowing in. People are feeling good about gains. | Hold your winners, but start tightening stop-losses. Take some partial profits. Avoid FOMO-driven purchases of the hottest, most-hyped assets. |

| 75-100: Extreme Greed | Euphoria & Complacency. “This time is different.” Everyone is a genius. Risk is ignored. | Scale out of positions. Be heavily in profit-taking mode. This is when you should be most cautious about new buys. It’s a signal to preserve capital. |

The key is the verbs: scale into and scale out of. It's a process, not an event.

Crypto Fear & Greed vs. Stock Market Fear & Greed: Key Differences

They're siblings, but not twins. The Crypto Fear and Greed Index is like the stock market version on a double espresso.

Volatility: Crypto swings are wilder and faster. The index can go from “Extreme Greed” to “Extreme Fear” in a matter of days, not weeks. This makes its signals more frequent but also more prone to false alarms (whipsaw).

Retail Influence: Crypto markets have a higher proportion of retail traders, who are generally more emotionally driven. This amplifies sentiment extremes.

24/7 Market: There's no closing bell to cool off emotions. Panic or euphoria can build continuously.

My rule of thumb: I give the crypto index a shorter “shelf life.” A reading from 3 days ago might already be outdated. For stocks, the sentiment shift is usually more gradual.

Moving Beyond the Index: Building a Sentiment Toolkit

Don't put all your faith in one gauge. Cross-reference it. Here’s what I look at:

AAII Investor Sentiment Survey: This is the actual survey the Fear and Greed Index tries to mimic with data. The American Association of Individual Investors asks members weekly if they are bullish, bearish, or neutral. It's a classic contrarian indicator. When bullishness is very high, be wary. When bearishness is extreme, opportunity often follows.

Put/Call Ratios: I look at the CBOE Equity Put/Call ratio myself. A spike often coincides with fear. A very low ratio shows complacency (lots of calls, few protective puts).

News Headline Tone: This is qualitative. When financial news headlines shift from cautious optimism to outright euphoria (or from concern to doom-porn), it's a sentiment clue. I remember late 2021 headlines; they were dripping with greed.

The Fear and Greed Index is a powerful piece of the puzzle. It gives you a name and a number for the gut feeling you get watching the markets. But it’s just one piece.

Use it to understand the emotional backdrop, to caution you against the herd at extremes, and to give you the confidence to be contrarian when it's hardest. But always, always pair it with your own research on value, trends, and fundamentals. That's how you move from reacting to the market's mood to actually understanding it.

Leave A Comment