Bitcoin Fear and Greed Index Explained: How to Use It for Trading

Advertisements

Quick Navigation

- What's Cooking in the Index Kitchen? The Ingredients Explained

- Decoding the Meter: From Extreme Fear to Extreme Greed

- How to Actually Use It (Without Losing Your Shirt)

- Looking Back: How Has the Index Actually Performed?

- The Limitations and Criticisms (You Need to Know These)

- Answers to the Questions You're Probably Asking

- Putting It All Together: Your Action Plan

Let's be honest. Trading Bitcoin can feel like trying to read the mood of a room full of caffeine-fueled traders who just had too much sugar. One minute everyone's cheering, prices are mooning, and your Twitter feed is nothing but "#BTCto100k". The next, it's all doom, gloom, and people talking about the death of crypto (again). Wouldn't it be nice if there was a single meter that tried to measure this collective emotional chaos? Well, there is. It's called the Bitcoin Fear and Greed Index.

I first stumbled across this index a few years back, deep in a crypto rabbit hole. It was during one of those brutal bear markets where every piece of news seemed negative. The index was sitting deep in "Extreme Fear" territory. My gut told me to sell everything and run. But something about that meter made me pause. It was quantifying the panic I felt all around me. That moment changed how I looked at market sentiment.

This thing isn't a crystal ball. It won't tell you exactly when to buy or sell. Anyone who claims it does is probably trying to sell you something. But as a tool to understand the market's psychological temperature? It's surprisingly useful, if you know how to read it.

So, What Exactly Is This Index?

In simple terms, the Bitcoin Fear and Greed Index is a daily score from 0 to 100. A score of 0 means the market is paralyzed by fear. A score of 100 means the market is irrationally greedy, drunk on its own optimism. It was created by the folks at Alternative.me as a way to quantify the two primary emotions that drive financial markets. The core idea is simple, almost too simple: extreme fear can signal a buying opportunity, while extreme greed often precedes a market top or correction.

You can find the current reading on their website. It's usually displayed with a big, colorful meter that's hard to miss. Green for greed, yellow for neutral, red for fear. It's visual, immediate, and taps right into our lizard brains.

But here's the question most people don't ask right away: what's actually going into that number? It's not just some guy's opinion. They pull data from several different sources to try and get a rounded picture.

What's Cooking in the Index Kitchen? The Ingredients Explained

This is where the Bitcoin Fear and Greed Index gets interesting. It's a composite. Think of it like a soup made from five main ingredients. Each one measures a different aspect of market behavior, which is smarter than just looking at price alone. Price can lie, or at least tell an incomplete story. But combining price action with social media buzz, trading volumes, and surveys gives you a fuller picture.

The exact weighting is a bit of a secret sauce (they don't publish the precise formula), but we know the key components. Understanding these helps you see what the index is really reacting to.

| Data Source | What It Measures | Why It Matters |

|---|---|---|

| Volatility (25%) | The size and frequency of Bitcoin's price swings. | High volatility often correlates with fear and uncertainty. When prices are jumping all over the place, people get nervous. |

| Market Momentum & Volume (25%) | The strength and volume of recent price moves and buying/selling activity. | Huge volume on upswings suggests greed and FOMO (Fear Of Missing Out). Heavy sell volume points to fear. |

| Social Media (15%) | The rate and sentiment of posts on Twitter and Reddit. | A surge in posts and positive hashtags (#bullish, #tothemoon) signals greed. Silence or negative dominance signals fear. |

| Surveys (15%) | Polls from various crypto community platforms. | Directly asks people how they're feeling. Can be noisy but adds a pure sentiment layer. |

| Dominance (10%) | Bitcoin's market share compared to all other cryptocurrencies. | In times of fear, money often flows back to Bitcoin as the "safe haven" crypto. In greed phases, money flows out to riskier altcoins. |

| Trends (10%) | Google Trends data for Bitcoin-related search terms. | Spikes in search interest often coincide with price peaks and greed. Low search interest can indicate apathy or fear. |

See? It's more than just a mood ring. It's crunching real data. The volatility metric, for instance, often pulls from established market data providers. The social media analysis isn't just counting posts; it's doing basic sentiment analysis, looking for positive and negative keywords. It's a primitive form of what hedge funds spend millions on.

But is mixing Twitter hype with price volatility a perfect science? Not even close.

Decoding the Meter: From Extreme Fear to Extreme Greed

Okay, so you see the number. It's 78. Or 15. What does that actually mean for you, sitting there wondering if you should hit the buy button? The index breaks down into five main zones. Each one tells a different story about the market's collective psychology.

0-24: Extreme Fear

The market is in panic mode. News is overwhelmingly negative. Social media is a graveyard or filled with anger. You'll see comments like "It's over" and "I'm never touching crypto again." Long-term holders are feeling pain, and weak hands are selling at a loss. This is where the famous Warren Buffett quote, "Be fearful when others are greedy, and greedy when others are fearful," feels most relevant. Historically, prolonged periods in Extreme Fear have often (but not always!) preceded significant price bounces. The key word is prolonged. A single day in extreme fear doesn't mean much.

I remember December 2018. The index was stuck below 20 for what felt like ages. Bitcoin had crashed from its 2017 high of nearly $20,000 to around $3,200. The feeling was utterly hopeless. Every crypto news site was publishing obituaries for Bitcoin. That was a classic Extreme Fear scenario. For those with the stomach for it, it was a brutal but potentially opportune time to accumulate.

25-49: Fear

The mood is pessimistic, but not apocalyptic. Investors are worried, cautious, and likely sitting on the sidelines. There's more selling pressure than buying pressure. This is a zone of anxiety and uncertainty. It's not a screaming buy signal, but it's a zone where smart money often starts paying very close attention, looking for signs of stability.

50: Neutral

The market is balanced. There's no strong emotional bias. This is arguably the most boring reading, but also the most rare in crypto. Price action is likely driven more by specific news or technical factors than by broad-based euphoria or panic.

51-74: Greed

Optimism is building. Prices are rising, and people are starting to feel good (or regretful for not buying earlier). You'll see more bullish talk online. New money might be trickling in. This is where most bull markets spend a lot of their time. It feels good, but it's also where you need to start being cautious about your risk management. Don't get carried away.

75-100: Extreme Greed

This is the party zone. Euphoria has taken over. Everyone is a genius. Your Uber driver is giving you Bitcoin tips. Meme coins you've never heard of are pumping 100% in a day. "This time is different" and "Price only goes up" become common refrains. The Crypto Fear and Greed Index flashing in the 80s or 90s is a classic contrarian warning sign. It doesn't mean a crash is coming tomorrow, but it signals that the market is overheated and vulnerable. This is when taking some profit off the table is rarely a bad idea.

Think back to late 2017 or April 2021. The index was pegged at 95+ for days on end. The atmosphere was pure mania. That's Extreme Greed in its purest form.

How to Actually Use It (Without Losing Your Shirt)

Here's the million-dollar question. You've got this index. Now what? This is where most guides get vague. Let's get specific. The Bitcoin Fear and Greed Index is a context tool, not a timing tool. You don't buy the instant it hits 10. You use it to understand the environment you're trading in.

For Long-Term Investors (The "HODLers")

If you're in it for the long haul and believe in Bitcoin's future, the index can be a great guide for your accumulation strategy. The concept is called "fear-based DCA" (Dollar-Cost Averaging). Instead of buying a fixed amount every week no matter what, you scale up your buys when the index is in Fear or Extreme Fear. You're essentially buying more when the market is on sale and sentiment is terrible. When the index is in Greed or Extreme Greed, you stick to your regular plan or even pause buys altogether. You're not trying to catch the absolute bottom—that's impossible—you're just improving your average entry price by being more aggressive when others are scared.

I've tried this myself. During the 2022 crypto winter, when the index was bouncing between 10 and 30 for months, I doubled my usual monthly buy amount. It was psychologically tough—buying while everything was red and everyone was predicting $10k Bitcoin. But it significantly lowered my average cost basis for the cycle. It forced me to act against my gut feeling, which is usually the right move in investing.

For Traders and Short-Term Players

For you, the index is a risk gauge. It tells you how crowded one side of the boat might be.

- High Greed (75+): This is a warning to tighten your stop-losses, take partial profits, and avoid opening large new long positions. The risk of a sharp correction is elevated. Consider if the market needs a "reset." It's also a time to be wary of FOMO—just because an asset is going up doesn't mean you should chase it.

- High Fear (Below 30): This doesn't mean you immediately go all-in long. It means you start looking for confirmation of a reversal. Are selling volumes drying up? Is there a bullish divergence on the chart (price makes a lower low but the RSI or MACD makes a higher low)? The index says sentiment is terrible, which is a necessary condition for a bottom, but not a sufficient one. Wait for price action to confirm.

- Neutral Zone (40-60): In this zone, the index is less useful for directional bias. Focus more on technical analysis, news, and on-chain data here.

A Major Caveat: It's a Lagging Indicator

This is the biggest critique, and it's valid. The Fear and Greed Index is reactive. It's calculated from data that has already happened. By the time it hits "Extreme Greed," the rally might already be a month old. By the time it plummets to "Extreme Fear," the crash might be halfway done. It confirms what you're already seeing; it rarely predicts what will happen next. Relying on it alone is a recipe for getting whipsawed. You must combine it with other tools.

Looking Back: How Has the Index Actually Performed?

Let's put on our historian hats. Does this thing have a track record, or is it just a fancy thermometer? Looking at major market cycles is revealing.

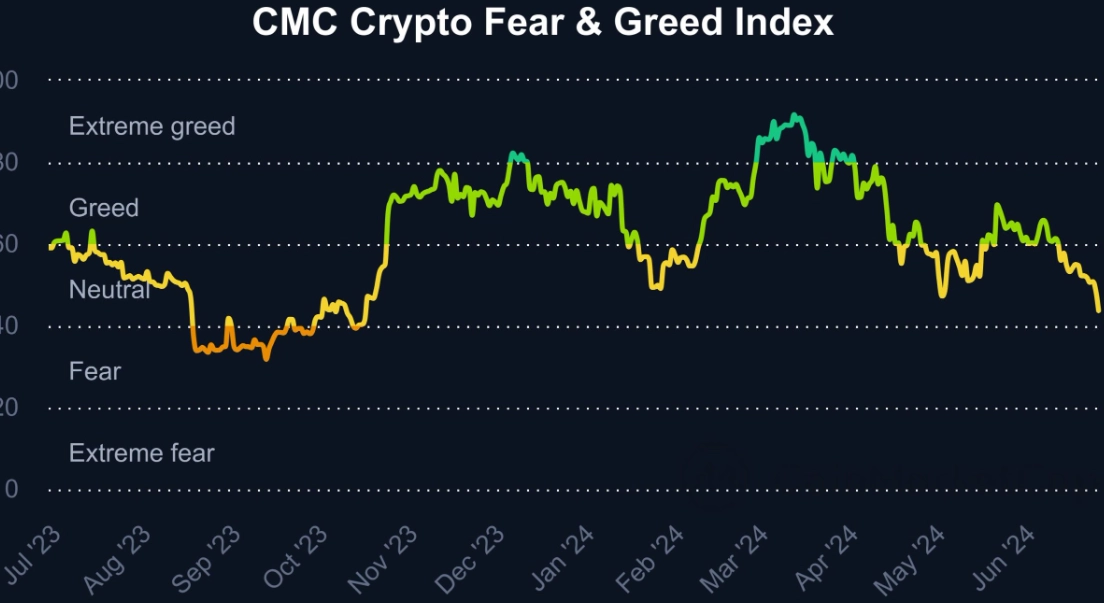

During the 2017 bull run peak in December, the index was consistently above 90. The subsequent crash in 2018 saw it plunge into Extreme Fear, where it remained for most of the year. It accurately captured the emotional arc of the cycle.

The March 2020 COVID crash is a fascinating case study. Bitcoin plummeted from ~$9,000 to below $4,000 in days. The Bitcoin Fear and Greed Index hit an astonishingly low 8. That was pure, unadulterated panic. That level of extreme fear marked a generational buying opportunity, as Bitcoin then began its historic run to $69,000. Major financial outlets like CNBC and Reuters even reported on the market panic at the time, which the index perfectly quantified.

In April 2021, when Bitcoin hit its then-all-time-high near $65,000, the index was again in Extreme Greed (around 95). The market then corrected by over 50% in the following months. Fast forward to November 2021, Bitcoin hits its cycle peak of $69,000. Guess what? The index was back in the mid-80s (Greed), but interestingly, not at the extreme 95+ level. This shows a potential divergence—price made a new high, but euphoria wasn't as intense as in April. Some analysts saw that as a bearish divergence.

So, it's not perfect. It doesn't call the exact top or bottom. But it does an excellent job of framing the market's psychological state at key turning points. It gives you a data point to say, "Okay, sentiment is at an extreme. I need to be extra cautious (or contrarian) right now."

The Limitations and Criticisms (You Need to Know These)

I wouldn't be doing my job if I just praised the index. It has real flaws. Ignoring them is dangerous.

First, it's Bitcoin-centric. Even though there's now a general "Crypto Fear and Greed Index," the original and most followed one is for Bitcoin. In altcoin seasons, the broader crypto market can be in Extreme Greed while Bitcoin is stagnant. Your altcoin portfolio might not follow Bitcoin's sentiment meter.

Second, it can stay at extremes for a long time. A market can be "Extremely Greedy" for weeks during a powerful bull run. Selling just because it hits 80 would have caused you to miss massive gains in 2017 and 2021. Conversely, it can be in "Extreme Fear" for months in a grinding bear market (like 2018-2019). Buying at 15 doesn't guarantee an immediate bounce; you could watch your investment drop another 50%. This is the single most painful lesson for new users of the index.

Third, it's vulnerable to data manipulation. The social media component? Bot networks can pump out positive or negative tweets. The survey component? Can be brigaded by communities. It's not a huge factor, but it's a vulnerability.

Fourth, and most importantly, it lacks nuance. A score of 20 could mean a slow, apathetic grind down (boredom fear) or a violent, panic-selling crash (terror fear). The index score is the same, but the market dynamics are completely different. You have to look at the chart itself to know which one you're in.

My personal take? The index is best used as a secondary confirmation tool. Your primary tools should be price action analysis, on-chain metrics (like those from Glassnode or CoinMetrics), and fundamental news. The Fear and Greed Index is the seasoning, not the main course.

Answers to the Questions You're Probably Asking

Putting It All Together: Your Action Plan

Alright, let's wrap this up with something practical. How do you start using this today without overcomplicating things?

- Bookmark the page. Go to the official index page and save it. Make it a habit to glance at it when you're checking prices.

- Define your zones. Decide what "Extreme Fear" and "Extreme Greed" mean for you. Maybe for your long-term plan, Extreme Fear is below 25. Maybe for your trading, Extreme Greed is above 80. Write these thresholds down.

- Create simple rules. For example: "If index 85, I will sell 10% of my trading portfolio to secure profits." Simple, predefined rules remove emotion.

- Always seek confirmation. Never act on the index alone. If it's at 12 (Extreme Fear), open your chart. Is the price still crashing on high volume? Wait. Is it starting to consolidate on low volume? That's a better sign. Look for alignment with other data.

- Review and adjust. Every few months, look back. Did your rules work? Did you panic and ignore them? The index is also a tool to check your own psychology against the market's.

The Bitcoin Fear and Greed Index is ultimately a mirror. It reflects the emotional state of the market, which is really just the combined emotional state of thousands of individuals like you and me. In that sense, understanding it is as much about understanding yourself as it is about understanding Bitcoin. When it screams "Extreme Greed," it's asking you, "Are you being greedy too?" When it whispers "Extreme Fear," it's asking, "Are you letting panic drive your decisions?"

Use it as that mirror. Not as a map. The map is the chart, the fundamentals, the technology. The mirror just helps you see if you're still clear-eyed enough to read it.

And sometimes, the most valuable thing it does is give you permission to do nothing. To wait. To watch. When emotions are running at extremes, the best trade is often no trade at all. Just a thought.

Leave A Comment