The Ultimate Guide to Understanding Bitcoin Trends: Analysis, Drivers & Future Outlook

Advertisements

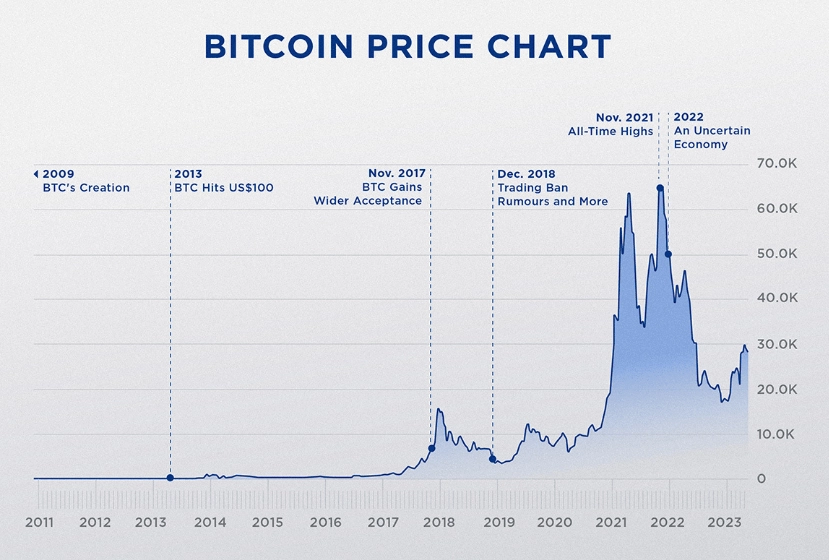

Let's be honest, trying to figure out the Bitcoin trend can feel like reading tea leaves during a hurricane. One day it's "digital gold," the next it's a speculative bubble, and the charts look like a heart monitor for a caffeine-addicted squirrel. I remember staring at my screen in late 2022, watching the price crater, and thinking, "Well, that's it. It's over." Everyone was saying it. The news was brutal. And yet, here we are. It wasn't over. That's the first lesson about Bitcoin trends: they are brutally cyclical, emotionally draining, and if you only look at the day-to-day noise, you'll miss the entire story.

Quick Guide to Bitcoin Trends

So, what is a Bitcoin trend, really? It's not just the line on a price chart going up or down. A true Bitcoin trend is a confluence of things: price action, sure, but also adoption rates, developer activity, regulatory whispers, macroeconomic winds, and the collective mood of millions of people worldwide. It's a multi-layered beast. This guide isn't about giving you a crystal ball—no one has that. It's about giving you the map and compass to navigate this landscape yourself. We'll strip away the hype, look at what actually moves the needle, and talk about how to think about Bitcoin's future without getting swept away by fear or greed.

The Core Idea: A sustainable Bitcoin trend is rarely about one thing. It's a story written by supply and demand, technology, human psychology, and global finance, all at once. Ignoring any one of these chapters will lead to a poor reading of the overall narrative.

What Actually Drives a Bitcoin Trend? The Key Engines

If you want to understand where Bitcoin is going, you need to know what's pushing it. People throw around terms like "institutional adoption" and "macro factors," but what do they mean in practice? Let's break down the real engines under the hood.

The Unchangeable Core: Supply and Halvings

This is Bitcoin's secret sauce, its built-in economic policy. There will only ever be 21 million Bitcoin. Full stop. New coins are created through mining, but the reward for miners gets cut in half roughly every four years in an event called "the halving." Think of it as a scheduled supply shock. The last halving was in May 2020, the next is expected in April 2024. Historically—and I stress, past performance is no guarantee—these events have preceded major bull markets. Why? Because the daily new supply gets squeezed, and if demand stays steady or increases, basic economics kicks in. The Bitcoin halving is the most predictable factor in its entire trend analysis, a north star in a very cloudy sky.

But here's my personal take: the effect of each halving might diminish over time. The first one was a curiosity, the second proved a pattern, the third created a legend. Now, with so much attention on it, the 2024 halving might be partially "priced in" ahead of time. It's still crucial, but it's not a magic button.

The Demand Side: Who's Buying and Why?

This is where it gets messy and interesting. Demand isn't just "more people." It's fragmented.

- The Retail Frenzy vs. The Quiet Accumulation: The 2017 trend was powered by retail mania—your friends and neighbors asking how to buy. The 2020-2021 trend had a huge component of institutional players like MicroStrategy, Tesla, and various funds making billion-dollar bets. That changed the game. It added a layer of sticky, long-term demand that doesn't panic-sell as quickly. Tracking large wallet movements (often called "whale" activity) on a site like CoinMetrics can give clues about this institutional Bitcoin trend.

- The Macro Hedge Narrative: When central banks print money and inflation runs hot, some investors flock to Bitcoin as a hedge, similar to gold. This became a massive driver post-2020. Watching inflation data, interest rate decisions from the Fed, and the strength of the US dollar becomes part of reading the Bitcoin trend now. It's frustrating because it ties Bitcoin to traditional finance it was supposed to bypass, but that's the reality.

- Adoption as a Network: Real, utility-driven demand is the holy grail. Are people using Bitcoin to send remittances? Are companies building on its base layer (like the Lightning Network for payments)? This growth is slower and less sexy than price spikes, but it's the foundation for long-term value. The Bitcoin.org ecosystem page shows some of this activity, but it's harder to quantify than a price chart.

The External Weather: Regulation and Sentiment

You can't ignore the weather. A major regulatory crackdown in a large economy (like China's mining ban in 2021) can crush a trend in the short term. Conversely, clear regulatory frameworks (like MiCA in Europe) can encourage institutional participation. You have to keep one eye on statements from bodies like the U.S. Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC).

And then there's sentiment—the fear and greed in the air. It's fluffy, but it matters. After a long bear market, even good news can be ignored. After a long bull run, bad news gets shrugged off. It's a feedback loop. I use tools to gauge this, but sometimes just scrolling through serious crypto Twitter (not the shill accounts) or developer forums gives you a gut feel that the data misses.

| Driver | How It Influences Trend | Time Horizon | Reliability as an Indicator |

|---|---|---|---|

| Halving Cycle | Reduces new supply; creates predictable scarcity events. | Long-term (4-year cycles) | High (event is certain; market reaction is historical but not guaranteed) |

| Institutional Adoption | Adds large, often long-term buy-side pressure; increases legitimacy. | Medium to Long-term | Medium-High (public filings like SEC Form 13F provide clear data) |

| Macroeconomic Conditions | Inflation, interest rates, and USD strength influence investor appetite for risk/hedge assets. | Short to Medium-term | Medium (correlation is strong but not perfect) |

| Regulatory News | Can cause immediate panic or euphoria; shapes the operating environment. | Short-term (Volatility Spike) | Low (news is unpredictable; market often overreacts initially) |

| On-chain Activity & Tech Development | Measures network health, utility, and developer confidence. | Long-term (Fundamental Health) | High (data is transparent and objective, but slow-moving) |

See? No single driver tells the whole story. A positive regulatory shift might be offset by a hawkish Fed. A halving might coincide with a global recession. You have to weigh them all.

How to Analyze a Bitcoin Trend: Moving Beyond the Price Chart

Okay, so you know the drivers. How do you actually track them? This is where you move from being a spectator to having a semi-informed opinion. Ditch the 1-minute chart. Seriously. It's noise. Here's what I actually look at, in order of importance.

1. On-Chain Analytics: The Truth is in the Code

This is my favorite part. The Bitcoin blockchain is a public ledger. Every transaction is there for anyone to analyze. This gives us hard data on investor behavior that you just don't get with stocks.

Key On-Chain Metrics I Watch:

- Realized Cap vs. Market Cap: Realized Cap values each coin at the price it last moved, not the current price. When Market Cap falls below Realized Cap, it often signals a market bottom (most holders are underwater).

- MVRV Z-Score: A fancy stat that compares market value to realized value. High values mean the market is overvalued relative to its historical norm (top signal). Low values signal undervaluation (bottom signal). Glassnode is the go-to for this.

- Supply in Profit/Loss: What percentage of coins are currently in profit? When almost everyone is in profit (over 95%), a pullback is likely. When almost no one is (under 50%), it can be a brutal but potential buying zone.

- Hodler Net Position Change: Are long-term holders (addresses holding for 1+ years) accumulating or distributing? When they accumulate during a bear market, it's a hugely bullish sign of conviction.

These metrics don't tell you what will happen tomorrow. But they give you a sense of the market's underlying health and stress levels. It's like checking the blood pressure of the network.

2. Technical Analysis (TA): Useful, Not Gospel

I have a love-hate relationship with TA. Used properly, it identifies levels of support (where buyers step in) and resistance (where sellers appear). It helps with risk management. The 200-week moving average has been an uncannily good support level in Bitcoin's history. The weekly and monthly charts are far more reliable than daily ones.

But here's the negative part: TA in crypto is often abused.

You'll see people drawing a hundred lines on a chart and claiming it predicts everything. It doesn't. A major news event will obliterate any triangle or wedge pattern. Use TA to understand market structure and key levels, not to predict the future with certainty. Combining a key support level from a weekly chart with a bullish on-chain signal? Now that's a more interesting story.

3. Sentiment Gauges: The Contrarian Compass

When everyone is screaming "To the moon!" it's probably time to be cautious. When headlines are declaring Bitcoin dead and forums are filled with despair, it's often worth a closer look. The Fear & Greed Index is a popular, simple tool that aggregates various sentiment sources. I find it most useful at extremes. A reading of 90+ (Extreme Greed) has often preceded corrections. A reading below 10 (Extreme Fear) has marked painful but significant bottoms.

Personal Anecdote: In early 2023, after the FTX crash, sentiment was apocalyptic. The Fear & Greed Index was stuck in "Extreme Fear" for months. On-chain data showed long-term holders were accumulating, not selling. That dissonance—between the terrified narrative and the steadfast behavior of the most committed players—was one of the clearest signals I'd seen in a while. It didn't mean an immediate V-shaped recovery, but it strongly suggested the worst of the selling was over. That's how you use these tools together.

The Future of Bitcoin Trends: Three Potential Paths

Predicting is a fool's errand, but thinking in scenarios is useful. Based on the drivers we've discussed, here are three broad, plausible paths for the long-term Bitcoin trend. I lean towards one, but you need to decide for yourself.

Path 1: The Digital Gold Standard (The Bull Case)

This is the dominant narrative among maximalists. Bitcoin succeeds primarily as a non-sovereign store of value, a "digital gold." In this future, its price trend is driven by gradual, relentless adoption by nation-states, corporations, and individuals as a treasury reserve asset. Volatility decreases over decades as the market matures. Its correlation with traditional risk assets lessens. Success looks less like parabolic spikes and more like a steep, steady upward grind, punctuated by cycles but with each cycle's low being higher than the last. The halving events continue to be major macroeconomic events. This path requires continued relative geopolitical instability and fiat currency debasement.

Path 2: The Niche Tech Asset (The Pragmatic Case)

This is my personal leaning—a mix of optimism and realism. Bitcoin carves out a crucial but specific role. It becomes a foundational, high-security settlement layer and a sovereign-grade savings technology, but it's not the only game in town. It coexists with other blockchains, CBDCs, and traditional finance. Its price trend is still cyclical and volatile, but within a generally upward channel. It's widely held in diversified portfolios as a small, uncorrelated alternative asset class. Its utility for censorship-resistant transactions and savings in unstable economies remains its killer app. In this path, understanding the Bitcoin trend remains a specialized skill, but it's accepted as a legitimate, if quirky, part of the global financial system.

Path 3: The Faded Experiment (The Bear Case)

We have to consider it. A catastrophic bug (though the network's resilience makes this seem less likely over time), an overwhelmingly effective global regulatory ban that fractures liquidity, or the rise of a superior technology that captures its value propositions. In this case, the long-term trend is a slow, grinding decay after a final speculative mania. Adoption stalls, developer interest dries up, and it becomes a digital curiosity. I think the probability of this has decreased significantly since 2017, given the trillions in value that have flowed through it and the institutional infrastructure now built around it, but it's non-zero. Ignoring this possibility is irresponsible.

So, which is it?

I think Path 2 is the most likely. Path 1 is the dream, Path 3 is the risk. The actual future will probably contain elements of all three.

Your Questions, Answered (The FAQ I Wish I Had)

Let's get practical. Here are the questions that kept me up at night when I was starting, and the answers I've pieced together.

Is now a good time to buy Bitcoin, given the current trend?

I can't give financial advice, but I can tell you how to think about it. Never buy because of FOMO (Fear Of Missing Out). Ask yourself: What is the trend built on? Is it a hype-driven social media pump, or are there solid on-chain fundamentals (like accumulation by long-term holders) underneath a fearful price action? Dollar-cost averaging (investing a fixed amount regularly) is the single best strategy for 99% of people to navigate any trend, up or down. It removes emotion.

How can I tell if a Bitcoin trend is about to reverse?

Look for divergences. Is the price making new highs, but on-chain metrics like network activity or new address growth are lagging? That's a bearish divergence. Is the price hitting new lows in a downtrend, but the momentum indicator (like the RSI on a weekly chart) is making a higher low? That's a bullish divergence. Also, watch for exhaustion. A parabolic move straight up is almost always followed by a sharp correction. A slow, grinding sell-off on low volume is more sustainable than a panic crash.

What's the biggest mistake people make when analyzing trends?

Confusing a short-term price movement with a long-term trend. A 20% pump in a week is not a new bull market. A 30% crash in a month is not the end of Bitcoin. Zoom out. Look at the weekly and monthly charts. The second biggest mistake is confirmation bias—only seeking information that confirms what they already want to believe (that it will go up because they're holding, or down because they sold). You have to actively look for data that contradicts your thesis.

How important are "Bitcoin predictions" from influencers?

Most are entertainment, not analysis. Anyone giving you a precise price target and date is either lying or guessing. Pay far more attention to people who explain their reasoning, show their data (on-chain screenshots, macro charts), and openly discuss the risks to their outlook. The value is in the framework they use, not the prediction they make.

How do I manage risk in such a volatile asset?

This is the most important question. First, only invest what you can truly afford to lose completely. Second, have a plan before you buy. At what price will you take profits? (Taking some profit is never wrong). At what price will you admit you were wrong and cut losses? Write it down. Third, use dollar-cost averaging as mentioned. Fourth, consider storage security—most losses aren't from bad trades, but from hacks or losing your keys. Using a reputable custody solution or a hardware wallet isn't optional. The Bitcoin trend means nothing if you lose your coins.

Wrapping It Up: Building Your Own Conviction

At the end of the day, understanding the Bitcoin trend is about building your own conviction. It's about moving from "I heard it might go up" to "I see that the network fundamentals are strengthening during this price weakness, and the macro environment, while tough, is exactly the kind that historically has increased demand for its properties."

It's a continuous learning process. The drivers will evolve. New metrics will emerge. But the core principles—scarcity, verifiability, decentralization—remain. Don't chase the trend. Seek to understand the underlying currents that create it. That's how you move from being a passenger to being a navigator, even in these wild seas.

Start by picking one thing from this guide. Maybe start looking at the Fear & Greed Index once a week. Or bookmark an on-chain analytics site and just glance at the headline metrics. Build your understanding slowly, brick by brick. That's how you develop a sense for this that no AI, no influencer, and no panic-inducing headline can ever take away from you.

Leave A Comment