Crypto Fear and Greed Index: A Trader's Guide to Market Sentiment

Advertisements

快速导览

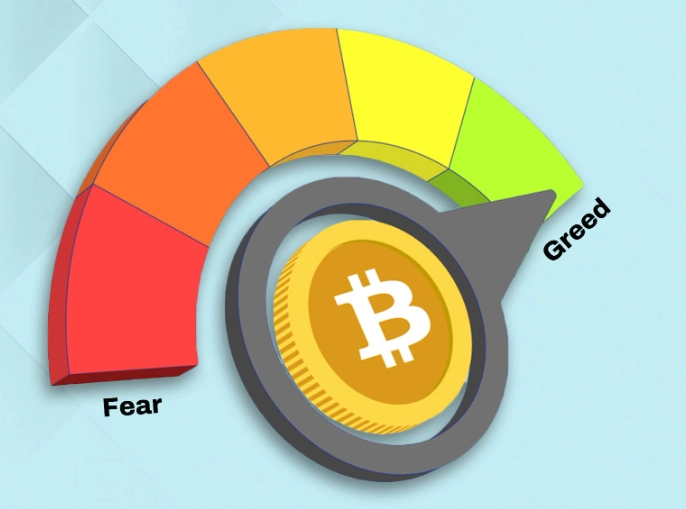

Ever felt the market is driven by pure emotion? One day, everyone's shouting "to the moon!" and buying anything with a blockchain. The next, it's all doom and gloom, and people are selling as if cash itself is about to expire. If you've been in crypto for more than a week, you know this rollercoaster all too well. The wild swings aren't just about tech or adoption; they're about human psychology. And that's where the Crypto Fear and Greed Index comes in. It's not a crystal ball, but it might be the next best thing: a thermometer for the market's emotional temperature.

I remember back in late 2022, everything felt bleak. News was bad, prices kept dipping, and the conversation online was overwhelmingly negative. I was hesitant to put any more money in, even though logically, some assets looked cheap. That feeling in the air, that collective anxiety, had a number: the Fear and Greed Index was hovering deep in "Extreme Fear" territory. Looking back, that was a signal I wish I'd paid more attention to. Conversely, when it hits "Extreme Greed," like it often does during parabolic rallies, that's usually when my friends who know nothing about crypto start asking me which coin to buy. That's never a good sign.

So, what is this index everyone keeps talking about on Crypto Twitter and in analyst reports? Let's break it down, without the jargon.

What Exactly Is It?

In simple terms, the Crypto Fear and Greed Index is a single number between 0 and 100 that tries to measure the primary emotions driving the cryptocurrency market at any given moment. A score of 0 represents maximum possible fear (think panic selling, capitulation), and a score of 100 represents maximum possible greed (think FOMO buying, irrational exuberance).

The idea isn't new. It's actually adapted from a concept in traditional stock market investing, famously used by investors like Warren Buffett. The old saying goes, "Be fearful when others are greedy, and greedy when others are fearful." This index gives you a data-driven way to see just how fearful or greedy "others" are. The most popular version of this index for crypto is published by the website Alternative.me. It's become a go-to resource because it's simple, visual (they use a simple meter and color code), and updates daily.

How Is It Calculated? (The Secret Sauce)

This is where it gets interesting. The index isn't just one guy's opinion. It's a composite score based on several different pieces of data from the market. Think of it like a recipe. The folks at Alternative.me look at six main ingredients, each giving a clue about market sentiment. They take data from these sources, normalize it, and crunch it into that final 0-100 score.

Here’s a look at the key ingredients in the Crypto Fear and Greed Index recipe:

| Data Source | What It Measures | Why It Matters |

|---|---|---|

| Volatility (25%) | The current volatility and market swings compared to historical averages. | High volatility often spikes during fear-driven sell-offs. Unusually low volatility during a bull run can also indicate complacency (a form of greed). |

| Market Momentum/Volume (25%) | The volume and strength of recent price action. | Huge buying volume on upswings suggests greed and FOMO. High selling volume on downticks screams fear. |

| Social Media (15%) | The rate and sentiment of posts on platforms like Twitter and Reddit. | A surge in posts, especially positive/hype-driven ones, indicates greed. Silence or a flood of negative posts points to fear. |

| Surveys (15%) | Polls conducted across various platforms. | Directly asks people how they feel. Can be noisy but adds a pure sentiment layer. |

| Dominance (10%) | Bitcoin's market share vs. the rest of the crypto market (altcoins). | When fear hits, money often flees risky altcoins back to the perceived safety of Bitcoin (BTC dominance rises). When greed is high, money flows into altcoins for bigger, faster gains (BTC dominance falls). |

| Trends (10%) | Google Trends data for search terms like "Bitcoin crash," "buy crypto," etc. | Spikes in searches for "buy" can mean greed. Spikes for "crash" or "sell" are pure fear indicators. |

They don't publish the exact, proprietary math (which is fair), but knowing the components helps you understand what's feeding the number. For instance, if the index is showing "Extreme Greed" but you notice Bitcoin dominance is actually rising, that might tell a more nuanced story than the headline number alone.

What Do the Scores Actually Mean?

Okay, so you see the number is 25 or 78. What now? The index breaks the 0-100 scale into colored zones with simple labels. This is its real power—instant interpretation.

| Index Value | Sentiment Label | Typical Market Mood & What It Often Means |

|---|---|---|

| 0 - 24 | Extreme Fear | Panic selling. Negative news dominates. Many give up. Historically, this zone has often preceded good long-term buying opportunities, but catching a falling knife is risky. |

| 25 - 46 | Fear | Widespread worry and uncertainty. Investors are cautious, selling outweighs buying. The mood is pessimistic. |

| 47 - 53 | Neutral | The market is in balance. No strong emotion dominates. Could be consolidation before the next big move in either direction. |

| 54 - 74 | Greed | Optimism is growing. Prices are rising, FOMO starts to creep in. People begin to expect the good times to roll forever. |

| 75 - 100 | Extreme Greed | Irrational exuberance. "This time is different" mentality. Everyone is a genius. Media is overwhelmingly positive. This is typically a danger zone for new buyers and a signal for experienced traders to consider taking profits. |

Here’s the thing. These zones aren't hard trading signals. A move into "Extreme Greed" doesn't mean the market will crash tomorrow. It means conditions are ripe for a top to form. Similarly, "Extreme Fear" doesn't guarantee an instant bounce. Markets can stay irrational longer than you can stay solvent, as the saying goes. I've seen the index sit in "Extreme Fear" for weeks during prolonged bear markets. It's more about probability and risk assessment than precise timing.

So, How Do You Actually Use This Thing?

This is the million-dollar question (sometimes literally). You don't just look at the number and blindly buy or sell. You use it as one tool in your toolbox. Here’s how I think about it, and how some smarter traders I know use it.

For Long-Term Investors (The "DCA" Crowd): If you're just dollar-cost averaging into Bitcoin or Ethereum every month, the index can be a fantastic gut-check. When the Crypto Fear and Greed Index is deep in the red (Extreme Fear), it might be a psychologically tough time to buy, but historically, it's also been a statistically better time to be accumulating. It reinforces the "be greedy when others are fearful" mantra. Conversely, when it's in Extreme Greed, it's not a signal to sell your entire long-term hold, but it's a strong reminder NOT to throw a large lump sum of new money into the market. Stick to your plan, but let the index temper your enthusiasm or fear.

For Traders & Active Investors: Here, the index can be more tactical.

- Contrarian Signal: A sustained period (multiple days) in Extreme Fear can be a flag to start looking for oversold assets to potentially go long. A sustained period in Extreme Greed is a flag to look for overbought conditions and consider taking profits or setting tighter stop-losses.

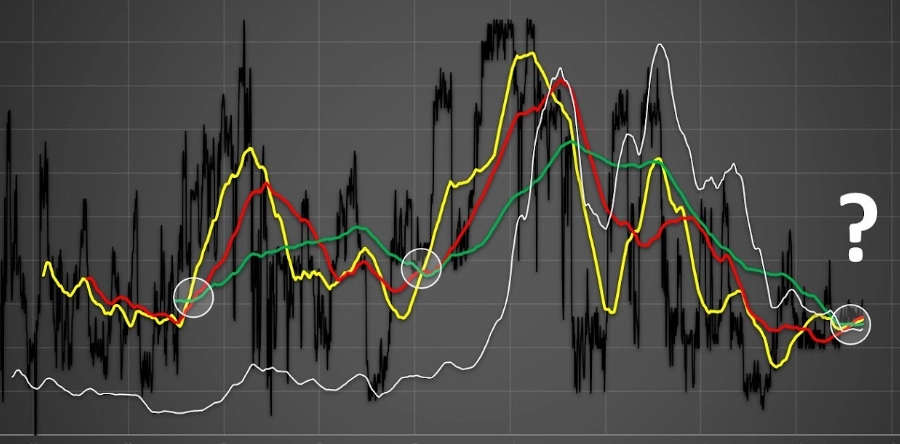

- Confirmation Tool: Never use it alone. If your technical analysis shows a strong support level being tested AND the fear and greed index is showing Extreme Fear, that confluence strengthens the case for a potential reversal. The same works in reverse for resistance and Extreme Greed.

- Risk Gauge: Simply put, entering new long positions when the index is >75 is generally a higher-risk move. Entering when it's

I made the mistake once of ignoring a reading of 95+ during the 2021 mania. My charts were screaming overbought, but the momentum was so strong I convinced myself "it's different." I bought a small-cap altcoin near its peak. The index was right; I was wrong. It wasn't a huge loss, but it was a cheap lesson in respecting sentiment extremes.

The Elephant in the Room: Limitations You Must Know

Look, no tool is perfect. If it were, we'd all be rich. The Fear and Greed Index for crypto has some real drawbacks you need to keep in mind.

- It's a Lagging Indicator: It reflects sentiment that has *already* been expressed in price, volume, and social media. It confirms what's happening; it doesn't predict what will happen next with certainty.

- It Can Get "Stuck": In a strong, steady bull market, it can sit in Greed or Extreme Greed for months. In a brutal bear market, it can be stuck in Fear forever. During these times, its short-term utility diminishes.

- Susceptible to Manipulation & Noise: Social media sentiment, a component of the index, can be gamed by coordinated groups. Viral fake news can cause temporary spikes in fear or greed that don't reflect the underlying reality.

- Black Swan Events: The index is built on recent historical data. A completely unforeseen, catastrophic event (a major exchange hack, a drastic regulatory crackdown) can render the current reading meaningless instantly.

- One Size Doesn't Fit All: It's a broad market indicator, primarily influenced by Bitcoin. The sentiment for a specific DeFi token or a niche Layer 1 project might be completely different.

My personal view? The biggest pitfall is using it as a standalone buy/sell signal. That's a recipe for disappointment. It's a context provider, not a prophet.

Your Burning Questions, Answered

How often is the Crypto Fear and Greed Index updated?

It updates once per day. Don't expect live, minute-by-minute changes. The data collection and calculation take time. You'll usually see the new daily value sometime in the early UTC morning. Some paid terminal services might try to create more real-time versions, but the standard public one is daily.

Is the Fear and Greed Index accurate?

That depends on what you mean by "accurate." Is it an accurate reflection of recent market sentiment based on the data points it tracks? Generally, yes—when you see Extreme Greed, the news is usually bullish, social media is hype-heavy, and prices have been running up. Does it accurately predict tomorrow's price? No. No single indicator does. Its "accuracy" is in quantifying the present emotional state, not forecasting the future.

Are there alternatives or similar indices?

Absolutely. The one from Alternative.me is just the most popular. You can find sentiment indicators on trading platforms like TradingView (look for social sentiment indicators for specific coins). Some analysts create their own versions using different weightings or data sources. The core concept remains the same: try to measure the market's mood.

Can I use it for stocks or other assets?

The original concept is from stocks! CNN Business maintains a Fear & Greed Index for the US stock market, using seven different indicators like market momentum, junk bond demand, and put/call options ratios. The principle is identical. It's a universal concept in behavioral finance.

What's a "good" score for buying?

There's no magic number. However, many value-oriented and contrarian investors start getting very interested when the index dips below 30 (Fear) and see the sub-25 (Extreme Fear) zone as an area where long-term opportunities are more likely to be found. Remember, "good" doesn't mean the price won't go lower. It means the emotional risk of a major crash from that point is lower, and the potential reward over the next 12-24 months is historically higher.

Does it work better for Bitcoin than for altcoins?

Yes, generally. Because Bitcoin dominance is a direct input and Bitcoin drives the overall market narrative, the index is most reflective of Bitcoin's sentiment environment. Altcoins, especially smaller ones, can and do deviate wildly. An altcoin can be in its own bubble of greed while the broader market index is in fear, and vice versa. Always check the specific asset's metrics.

The Final Word

At the end of the day, the Crypto Fear and Greed Index is a tool to help you do one thing: think independently. In a market driven by herd mentality, it gives you a data point to step back and ask, "Is the crowd too excited or too terrified right now?"

Will it make you a perfect trader? No. But it might stop you from making the worst emotional decisions at the worst possible times. Use it to question your own bias. If you're feeling incredibly bullish and want to go all-in, but the index is at 94, maybe pause. If you're scared to buy anything and the index is at 12, maybe dig deeper into the fundamentals of projects you believe in.

Combine it with your own fundamental research, technical analysis, and risk management. Bookmark the page on Alternative.me, check it once a day to get a pulse, and then get on with your strategy. Don't obsess over every single point move. The real value of understanding the Fear and Greed Index isn't in beating the market every time; it's in not letting the market's emotions beat you.

And that, in my view, is half the battle won.

Leave A Comment