Guide to Mining Crypto at Home: Is It Still Profitable?

Advertisements

Navigating This Guide

Let's be honest. The idea of mining crypto at home has this almost romantic appeal. It's the digital equivalent of panning for gold in your own backyard. You picture your computer humming away, quietly earning digital cash while you sleep. I remember getting hooked on that idea years ago, firing up my gaming PC to mine some Ethereum just for fun.

But you know what? The landscape has changed. Dramatically.

This isn't a hype piece telling you to go buy ten graphics cards tomorrow. This is a straight-talk guide about what mining crypto at home actually looks like right now. We'll dig into the real numbers, the hidden costs everyone forgets, and whether it's even a sensible hobby—or business—to start today. If you're thinking about dipping your toes into the world of home crypto mining, you need to read this first.

The Home Miner's Reality Checklist: Before we dive deep, here's the quick truth bomb. Mining crypto at home in 2024 is: 1) Not about getting rich quick with Bitcoin, 2) Heavily dependent on your electricity cost, 3) More accessible with certain altcoins, and 4) A technical hobby that requires patience. If you're okay with that, let's proceed.

Why Mining Crypto at Home Got So Hard

It wasn't always this tough. Back in the early days, you could mine Bitcoin with a regular CPU. Then GPUs took over. Now, for major coins like Bitcoin, specialized machines called ASICs rule the roost, and they're housed in massive, industrial-scale farms near cheap power sources. This shifted the goalposts for the little guy.

Three big things squeezed the home miner:

- Network Difficulty: This is a self-adjusting measure of how hard it is to find a new block. As more miners join the network, difficulty skyrockets. The Bitcoin network's hashrate is now mind-bogglingly high, making solo success at home nearly impossible without insane luck. You can check the current, staggering Bitcoin difficulty on sites like Blockchain.com.

- Electricity Costs: This is the silent profit killer. Mining hardware is power-hungry. If you're paying $0.15 per kWh or more, a huge chunk of your potential earnings just goes back to the utility company. In some countries with subsidized power, it might work. In many parts of the US and Europe, it's a brutal hurdle.

- Hardware Cost & Availability: Good mining rigs, especially ASICs or high-end GPUs, require a significant upfront investment. During bull markets, they get scalped and prices go through the roof. The ROI period can stretch out for a year or more, which is a lifetime in crypto.

So, is the dream of mining cryptocurrency at home dead? Not entirely. It's just evolved. You need a different strategy.

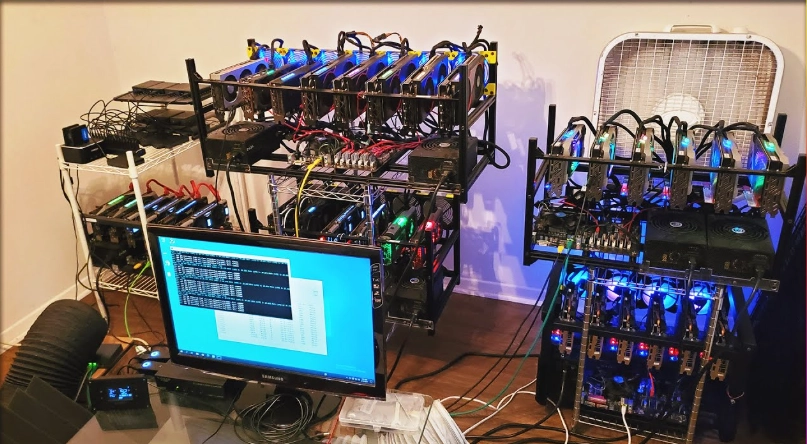

Your Hardware Options for Home Mining

Choosing your tool is step one. This isn't a one-size-fits-all game. The coin you want to mine dictates the hardware, and vice-versa.

| Hardware Type | Best For Mining... | Pros for Home Use | Cons & Warnings |

|---|---|---|---|

| CPU (Your Computer's Processor) | Privacy coins like Monero (XMR), VerusCoin (VRSC). | Uses existing hardware, low barrier to entry, quiet, low power draw relative to others. | Very low earning potential on most networks. You're basically just testing the waters. |

| GPU (Graphics Cards) | Ethereum Classic (ETC), Ravencoin (RVN), Ergo (ERG), and other Ethash/KawPow-based coins. | Flexible – can mine different algorithms, can be repurposed for gaming/resale, more accessible than ASICs. | Higher power draw, generates significant heat and noise, requires proper setup/risers, upfront cost is high. |

| ASIC (Application-Specific Integrated Circuit) | Primarily Bitcoin (SHA-256), Litecoin (Scrypt), Dash (X11). | Extremely powerful and efficient for their specific algorithm. The only viable way to mine Bitcoin at home with any hope. | Very expensive, extremely loud (like a vacuum cleaner), generates massive heat, obsolete quickly, inflexible. |

For most people starting out with mining crypto at home, GPU mining is the sweet spot. It's challenging but learnable. An ASIC is a commitment—you're buying a loud, hot appliance that does one thing. I once housed a small ASIC in a closet and the noise drove me nuts within a day. My family wasn't thrilled either.

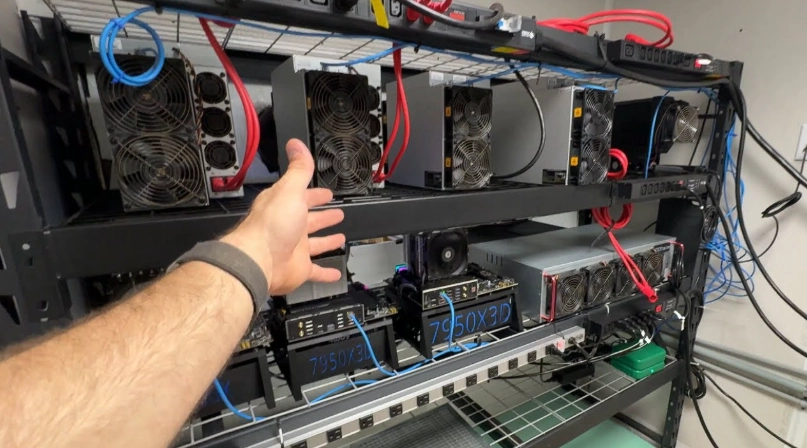

Breaking Down a GPU Mining Rig

Let's say you go the GPU route. It's not just about slapping cards into a PC. A dedicated rig is built for stability and airflow. Here's what you're looking at:

- GPUs (Graphics Cards): The workhorses. AMD (RX series) and NVIDIA (RTX series) are the main players. You don't always need the latest and greatest. Sometimes last-gen cards offer better efficiency.

- Motherboard: You need one with multiple PCIe slots. Mining-specific motherboards exist that can handle 6, 8, or even 12+ GPUs.

- Power Supply (PSU): This is critical. You need a high-wattage, high-quality PSU (80+ Gold or Platinum rating). Never, ever skimp here. A bad PSU can fry your entire investment. Calculate your total power needs and add a 20% buffer.

- Frame: An open-air metal frame is best for cooling. You can buy one or build a simple one from aluminum extrusion.

- Risers: These are PCIe extension cables that let you space out your GPUs on the frame for proper airflow.

- CPU, RAM, Storage: Basics. A cheap Celeron CPU, 4-8GB of RAM, and a small SSD or USB drive for the OS are enough.

Pro Tip: Don't buy all your gear new. The secondary market (eBay, Facebook Marketplace) is full of GPUs from miners upgrading or getting out. You can find good deals, but test the cards if possible. Look for cards that haven't been abused in dusty, hot environments.

The Real Math: Costs, Profitability, and Break-Even

This is where dreams meet Excel spreadsheets. Forget the flashy YouTube videos showing daily payouts. You need to run your own numbers.

Here are the variables you must plug into a mining calculator (like WhatToMine or NiceHash's calculator):

- Hardware Cost: Total price of your entire rig.

- Hashrate: The mining power of your setup (in MH/s, GH/s, etc.).

- Power Consumption (Watts): How much electricity your rig draws from the wall at the wall. Use a kill-a-watt meter for accuracy.

- Electricity Cost ($ per kWh): Find this on your utility bill. This is the most critical number.

- Pool Fees: Usually 1-2% if you join a mining pool (which you absolutely should).

The calculator spits out an estimated daily, monthly, and yearly profit. Now, do this:

Gross Profit = Coin Mined (value) - Electricity Cost

Net Profit = Gross Profit - Pool Fees - (Hardware Cost / Lifespan)

The Brutal Truth About Break-Even: Many beginners forget that hardware has a limited profitable lifespan (maybe 1-3 years). If your rig costs $3,000 and makes $5 a day after electricity, that's a 600-day break-even if the coin's price and network difficulty stay exactly the same. They won't. Difficulty usually goes up, and price is volatile. Your $5 today could be $2 tomorrow. This is the fundamental risk of mining crypto at home.

I view any profit from mining as a bonus. The primary goal should be accumulating coins you believe in for the long term, at a cost lower than buying them outright on an exchange. If you can't achieve that, it's a tough sell.

Step-by-Step: How to Start Mining Crypto at Home

Okay, you've done the math and you're still in. Let's walk through the actual process. It's less magic, more following instructions.

1. Choose Your Coin and Mining Pool

You're not mining solo. You join a pool where miners combine their power and share the rewards. Research pools for your chosen coin. Look at their fee structure, payout threshold, and reputation. For Ethereum Classic, pools like Ethermine or 2Miners are popular. For Ravencoin, you might look at Flypool or Nanopool.

2. Get a Crypto Wallet

You need a secure wallet address to receive your earnings. Never use an exchange address directly from a pool. Use a non-custodial wallet where you control the keys. For beginners, a software wallet like Exodus or Atomic Wallet is fine for smaller amounts. For serious earnings, consider a hardware wallet like Ledger or Trezor.

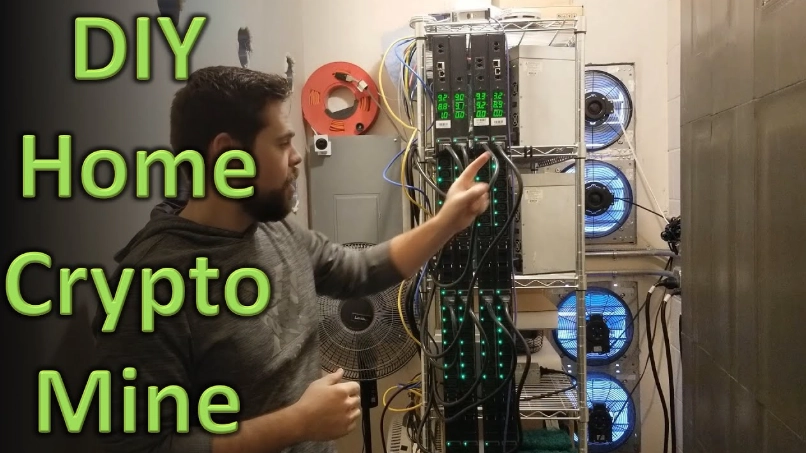

3. Set Up Your Mining Software & OS

Your rig needs an operating system. You can use a regular Windows install, but it's bloated. Most serious home miners use a dedicated mining OS like Hive OS or Rave OS. These are Linux-based, lightweight, and let you monitor and control your rigs remotely from a web dashboard. They're a game-changer.

Then, you need mining software that connects your hardware to the pool. Examples include T-Rex Miner (for NVIDIA), TeamRedMiner (for AMD), or GMiner. You'll configure it with your pool address and wallet.

4. Optimize, Monitor, and Maintain

This is the ongoing work. You'll need to:

- Overclock/Undervolt: Tweaking your GPU settings to get more hashrate for less power. This is where the real efficiency gains are. It requires patience and testing for stability.

- Monitor Temperatures: Keep your GPU core and memory temps in check (ideally below 70-80°C). High temps kill components fast.

- Clean Regularly: Dust is an insulator. Clean your rigs every few months with compressed air.

The Hidden Challenges: Noise, Heat, and Your Sanity

Blogs often gloss over this. Mining crypto at home has physical side effects.

Noise: Multiple GPU fans at 70%+ speed create a constant, noticeable drone. An ASIC is like having a jet engine in your house. You cannot put this in a living space you use. A basement, garage, or dedicated shed is often necessary. Soundproofing boxes can help, but they complicate cooling.

Heat: A 1000-watt rig is essentially a 1000-watt space heater. In the winter, this might be a perk. In the summer, it will strain your home's air conditioning, adding another hidden cost. Proper ventilation is non-negotiable.

Time & Attention: It's not a "set it and forget it" operation. Markets shift, coins fork, software needs updates. You need to stay informed. For me, the tinkering was part of the fun. If you just want passive income, this might not be your hobby.

The Future: What Does Proof-of-Stake Mean for Home Miners?

Ethereum's move to Proof-of-Stake (PoS) was a seismic event for GPU miners. It removed the largest altcoin mining network overnight. This is a crucial trend. More blockchains are exploring or adopting PoS or other consensus mechanisms that don't rely on competitive mining (Proof-of-Work).

So, is mining crypto at home a dying art?

Not necessarily, but it's niche-ing down. The future for home miners likely lies in:

- Supporting Smaller, GPU-Mineable Projects: Coins like Ergo, Nexa, or Kaspa are designed to be ASIC-resistant, aiming to keep mining decentralized and accessible to individuals with GPUs.

- Diversification: Some miners use software like NiceHash, which automatically rents out your hashing power to the highest bidder, paying you in Bitcoin. It's simpler but takes control away.

- The Merge-Mining Concept: Some projects allow you to mine two coins at once with the same work.

The key is adaptability. The coins you mine today might not be the ones you mine in six months. Follow the development communities of the projects you support.

Frequently Asked Questions (FAQs)

Is mining crypto at home legal?

In most countries, yes. However, you must report mining income on your taxes as ordinary income (based on the value when you receive it). Some localities or homeowner associations may have rules about excessive power use or noise. Always check local regulations.

Can I mine Bitcoin at home profitably?

With an ASIC miner and very cheap electricity (below $0.08/kWh), it's mathematically possible. But you're competing against industrial farms. For 99% of people, trying to profitably mine Bitcoin at home is an uphill battle you probably won't win. It's more realistic to mine other coins and trade them for Bitcoin.

How much money can I make mining crypto at home?

There is no single answer. It could be $1 a day or $20 a day with the same hardware, depending on coin value, network difficulty, and your power cost. You must use a profitability calculator with your specific data. Assume your initial estimates are optimistic.

What is the best cryptocurrency to mine at home for beginners?

Start with your existing computer's CPU. Mine Monero (XMR) for a few weeks using a simple GUI miner like XMRig. You'll earn pennies, but you'll learn the entire process—wallet setup, pool configuration, monitoring—with zero financial risk. It's the best training wheels.

Does mining crypto at home damage my computer?

If you run components hot (above 85-90°C consistently) and 24/7, you will shorten their lifespan. Proper cooling and conservative tuning (undervolting) are essential. A well-maintained GPU can last years mining. A neglected, overheated one can fail in months.

Final Take: Mining crypto at home today is less about striking it rich and more about participating in a network, learning about blockchain technology hands-on, and potentially accumulating coins in a novel way. It's a technical hobby with financial aspects, not an investment strategy. Go in with your eyes open, start small, and never invest money you can't afford to lose on hardware. The most successful home miners are the most curious and adaptable ones.

Maybe I'll see you on the pool. Happy mining.

Leave A Comment