The Pump and Dump Scheme: How to Spot and Avoid It

Advertisements

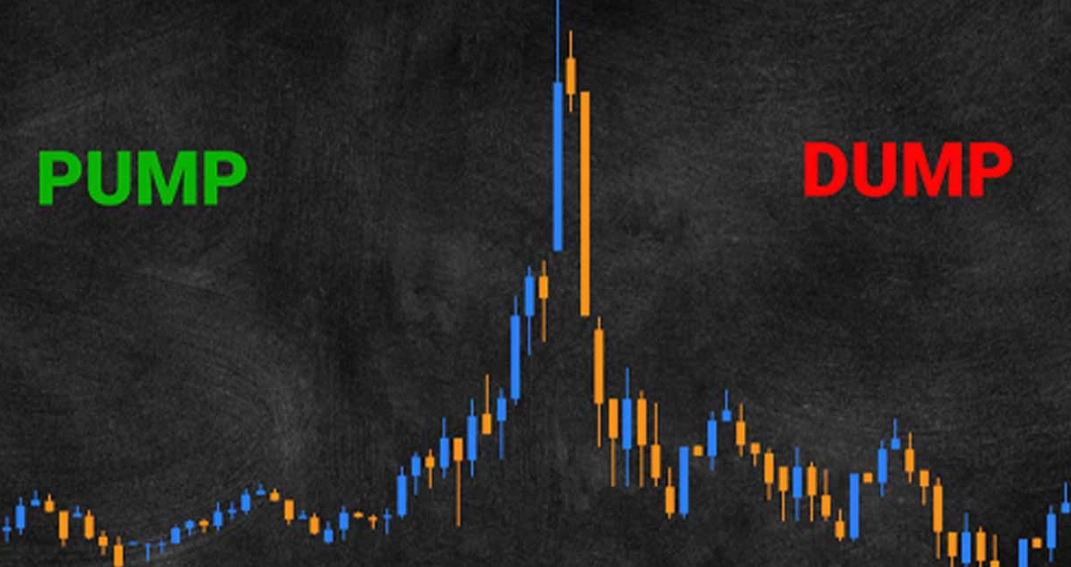

You're scrolling through Twitter or a Discord channel, and you see it. A chart shooting straight up. People are yelling "MOON!" and posting rocket emojis. A coin you've never heard of is up 300% in an hour. Your heart races a little. That's the feeling a pump and dump scheme is designed to trigger. It's not just a shady stock market trick from old movies; it's a live, evolving threat in crypto and small-cap stocks, and it feeds on the exact excitement it creates. Let's strip away the hype and look at the mechanics, because understanding how it works is the only vaccine.

What You'll Learn Inside

How Does a Pump and Dump Actually Work?

Forget complex definitions. It's a simple three-act play with a tragic ending for the audience.

Act 1: The Accumulation. A group (let's call them the organizers) quietly buys a large amount of a very cheap, low-volume asset. This is usually a penny stock trading for cents or a micro-cap cryptocurrency with a tiny market cap. The key here is low liquidity—it doesn't take much new money to move the price significantly. They often use offshore or anonymous wallets for crypto to hide their tracks.

Act 2: The Pump. This is the show. They start blasting out "news." It could be a fake partnership announcement, a paid influencer tweet, or a coordinated barrage in Telegram and Discord groups with thousands of members. The message is always urgent and promises insane returns. "This coin is about to be listed on Binance!" "This biotech stock has a secret cancer cure!" The goal is to create a frenzy of FOMO (Fear Of Missing Out). As retail investors pile in, the price shoots up. The organizers might even buy more themselves in the open market to fuel the rise, making the chart look parabolic.

Act 3: The Dump. At the peak of the hype, when buying is frantic, the organizers sell every single share or token they own. They hit the market with massive sell orders. The price plummets. The new buyers, who bought at the top, are left holding an asset worth a fraction of what they paid. The organizers vanish, profits secured. The community channel goes silent, or the moderators blame "paper hands."

The Organizer's Playbook: They often structure their sales in tiers. Some sell at the first sign of peak volume, others hold for a second smaller pump attempt. Their average sell price is far below the peak retail buyers paid, guaranteeing them profit even on the way down.

The Red Flags: How to Spot a Pump and Dump in Real Time

Knowing the theory is one thing. Spotting it as it's happening is another. Here are the signals that should make you hit the pause button.

The Social Media Storm

If the only place you're hearing about this "opportunity" is social media or private messaging apps, be extremely skeptical. Legitimate financial news breaks on financial wires, company filings (like the SEC's EDGAR database), or reputable news outlets. A frenzy confined to Telegram, Discord, or TikTok subreddits is a major warning.

Look at the language. Is it heavy on emojis (🚀, 🌙, 💎🙌) and light on facts? Are questions being deleted or the askers called "FUD spreaders"? That's a controlled narrative, not a discussion.

The Chart & Volume Tell the True Story

This is the most reliable indicator. Pull up the chart and look at the volume bar underneath the price.

| Signal | What It Looks Like | Why It's a Problem |

|---|---|---|

| Vertical Green Candle | Price goes nearly straight up in a very short time frame (minutes or hours). | Natural buying doesn't work like that. It's a sign of coordinated, urgent buying. |

| Isolated Volume Spike | A single, massive volume bar that dwarfs all previous activity, followed by a volume drop-off. | Shows the "pump" was a one-time event, not sustained interest. The drop-off is the "dump." |

| No Healthy Pullbacks | The price only goes up, with no natural consolidation or retracement. | In a healthy trend, profit-taking causes small dips. A manipulated pump has no room for that. |

The Anonymous or Sketchy Foundation

For crypto projects, can you actually find the development team? Are they using real names with LinkedIn profiles, or are they cartoon avatars? Is the "whitepaper" full of buzzwords but devoid of technical specifics or a real roadmap? For stocks, is the company a real operating business with revenues, or a shell company with a history of name changes and reverse splits? A quick search on the SEC website can reveal a lot.

A Common Mistake: New investors think, "If I just get in early and sell before the dump, I can profit too." This is playing with fire. You are competing against the organizers who control the timing, the messaging, and the order flow. You are the liquidity for their exit. More often than not, you become the bag holder.

Crypto vs. Stocks: Is One More Vulnerable?

Both arenas are targets, but the playing field is different.

Traditional Stock Market (Penny Stocks): The classic playground. Regulators like the SEC actively prosecute these schemes. They have tools: trading halts, subpoenas, charges for fraud and market manipulation. However, the sheer number of tiny OTC (Over-The-Counter) stocks makes policing difficult. The cycles can be slower, playing out over days or weeks.

Cryptocurrency Markets: This is the wild west. The global, 24/7 nature, combined with anonymous founders and cross-border exchanges with varying levels of oversight, makes it a perfect habitat for pump and dumps. They are faster, more brazen, and can target coins with almost no utility. A common tactic is the "telegram pump group," where members pay a fee for the signal to buy at the same time.

The core vulnerability in crypto is the low barrier to creating a token. Anyone can create a BSC or Solana token in minutes, provide initial liquidity, and start a pump group for it. There is zero underlying value.

How to Protect Yourself (Beyond Just 'Being Careful')

"Do your own research" is common advice, but here's what that actually means in this context.

- Verify, Don't Trust: If you hear a rumor about a partnership or exchange listing, go to the official website or Twitter of the alleged partner/exchange. I've seen countless fake screenshots. Go to the source.

- Check the Unloved Data: Everyone looks at the price chart. Savvy investors look at the order book depth (if available) and the ratio of buys to sells. In a pump, you'll see a massive sell wall just above the current price that never seems to get eaten—that's the organizers waiting to sell.

- Have a Rule-Based Exit: If you ever decide to engage with a highly speculative asset (not recommended), set a mental stop-loss before you buy. "If it drops 15% from my entry, I'm out, no questions." And stick to it. Emotion will tell you to hold.

- Understand Your Timeframe: Pump and dumps are ultra-short-term plays. If you're an investor with a months or years horizon, these assets should never be on your radar. The confusion happens when people conflate speculation with investment.

The most powerful protection is a simple mindset shift: view unexplained, hype-driven vertical price movements not as opportunities, but as warnings. Real wealth is built through patience and analysis, not chasing rockets.

Leave A Comment