Building a Profitable Bitcoin Mining Rig: A 2024 Guide

Advertisements

You see the price of Bitcoin ticking up, and that old thought creeps back in. "Maybe I should mine some." The idea of your own machine quietly printing digital money is intoxicating. I built my first rig back in 2017, a chaotic mess of GPUs whirring in my garage. The landscape today? It's a different universe. Let's cut through the hype and look at what building a Bitcoin mining operation actually involves now—the real costs, the hardware choices, and the brutal math of profitability.

What’s Inside This Guide?

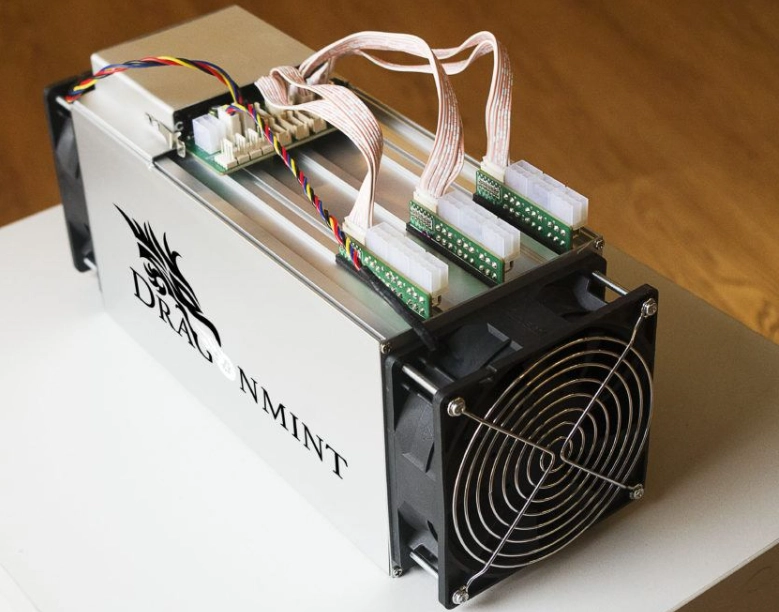

The Hardware Reality: ASICs Rule Everything

Forget everything you've seen about racks of glowing graphics cards. For Bitcoin, that ship sailed nearly a decade ago. Today, it's all about ASIC miners.

An ASIC (Application-Specific Integrated Circuit) is a chip designed to do exactly one thing: compute SHA-256 hashes for the Bitcoin network. It's useless for anything else, but for mining, it's millions of times more efficient than a CPU or GPU. This specialization created an industrial arms race.

The biggest players are Bitmain (Antminer series), MicroBT (Whatsminer), and Canaan (Avalon). Their latest models are engineering marvels—and power-hungry beasts.

What Are the Best ASIC Miners in 2024?

It's not about the "best" in raw power, but the best for your situation—usually balancing upfront cost and efficiency.

| Model | Approx. Hash Rate | Efficiency (J/TH) | Power Draw | Est. Price (New) | Best For |

|---|---|---|---|---|---|

| Bitmain Antminer S21 Hyd | 335 TH/s | ~16 J/TH | ~5360W | $5,000 - $6,500 | Large-scale ops with cheap power & advanced cooling. |

| Bitmain Antminer S19 XP | 141 TH/s | ~21.5 J/TH | ~3010W | $2,500 - $3,200 | The home miner's high-end benchmark. Manageable power. |

| MicroBT Whatsminer M50S | 126 TH/s | ~22 J/TH | ~2772W | $2,200 - $2,800 | Reliable alternative to Bitmain, often better availability. |

| Canaan Avalon A1366 | 130 TH/s | ~22 J/TH | ~2860W | $2,000 - $2,600 | Budget-conscious buyers seeking new hardware. |

| Used Antminer S19j Pro (96TH) | 96 TH/s | ~29.5 J/TH | ~2832W | $800 - $1,200 | Ultra-low entry cost. High power draw makes it risky if electricity isn't cheap. |

My take? The S19 XP or M50S represent the current sweet spot for serious home miners. The older, used S19j Pros are tempting for their price, but that worse efficiency is a silent profit killer. I bought one as a test, and at my $0.14/kWh rate, it barely broke even before difficulty jumped.

The Real Cost Breakdown of a Mining Setup

This is where dreams meet reality. The miner itself is just the headline cost.

Let's build a realistic budget for a single, new Antminer S19 XP setup:

- ASIC Miner (S19 XP): $2,800

- Power Supply Unit (PSU): $350. Don't cheap out here. You need a 220V+ server-grade PSU like an APW12 or HP1200.

- Ventilation & Cooling: $200 - $500. This could be a dedicated inline fan, ducting, and maybe a window box. If your ambient temperature is high, add air conditioning costs.

- Electrical Work: $500 - $2,000+. This is the silent budget killer. Your home's 110V circuit can't handle a 3000W+ load. You likely need a 220V/240V line run by an electrician. This cost varies wildly.

- Miscellaneous: $100. Ethernet cables, power cables, a simple frame or shelf, maybe a smart plug for monitoring.

Total Initial Investment: ~$4,000 - $6,000+

The Unforgiving Math of Mining Profitability

Let's run the numbers. This is the most important section. We'll use a mining calculator (like the one on CryptoCompare) as our reference point for variables.

Assumptions for our S19 XP (141 TH/s, 3010W):

- Bitcoin Price: $60,000 (volatile, I know)

- Mining Difficulty: Increases 5% monthly (it's been volatile, but trends up)

- Pool Fee: 2% (you'll join a pool like Foundry USA, Antpool, or ViaBTC)

- Your Electricity Cost: This is the king. We'll test two scenarios.

Scenario 1: Cheap Power at $0.07/kWh

Daily Revenue: ~$9.50

Daily Electricity Cost: ~$5.06

Daily Profit: ~$4.44

Monthly Profit: ~$133

Time to break-even on $4,500 setup: ~34 months. That's a long horizon, and difficulty will likely stretch it.

Scenario 2: Average US Power at $0.14/kWh

Daily Revenue: ~$9.50

Daily Electricity Cost: ~$10.11

Daily Profit: -$0.61

You are losing money from day one.

See the problem? Unless you have access to stranded power, subsidized electricity, or are in a cold climate where the heat is useful, the margins are razor-thin or negative for a small-scale miner. Large-scale operations in places like Texas or Canada have power contracts at 4-5 cents/kWh, which is a game we simply can't play.

A Step-by-Step Guide to Building Your Rig

If the numbers still make sense for you, here's how to physically set it up.

1. Secure Your Location and Power

This is step zero. Find a well-ventilated space that can handle noise and heat. Contact a licensed electrician to assess your panel and run a dedicated 220V/30A circuit. Do not skip this. Overloading a circuit is a major fire risk.

2. Order Your Core Components

Buy the ASIC miner and compatible PSU from a reputable vendor. Avoid sketchy marketplaces. Direct from manufacturer or authorized resellers is best for warranty. For used gear, check the seller's reputation meticulously.

3. Set Up Ventilation

ASICs have fans that exhaust hot air out one side. You need to duct that hot air directly outside, like a dryer vent. Simultaneously, ensure cool air is being pulled into the miner's intake. A simple setup: an inline fan pulling hot air out through a window seal kit.

4. Assemble and Connect

Mount the PSU to the miner (they usually attach directly). Connect the power cables from the PSU to the miner's board. Plug the 220V cable from the wall into the PSU. Connect an Ethernet cable from the miner to your router.

5. Configure and Join a Pool

Find the miner's IP address on your network (check your router's device list). Type that IP into a web browser. This brings up the miner's configuration page. Here, you'll enter the details of your chosen mining pool and your Bitcoin wallet address. Save the settings.

6. Monitor and Maintain

Let it run. Use the pool's dashboard or an app to monitor your hashrate and rewards. Clean the dust filters on the miner every few weeks. Heat kills electronics, so watch those intake temps.

Common Pitfalls and How to Avoid Them

I've made some of these mistakes so you don't have to.

Pitfall 1: Ignoring Efficiency (J/TH). Buying the highest hash rate for the lowest price is a trap. That older, inefficient miner will devour any potential profit in electricity. Always run the profitability calculator with your power rate before buying.

Pitfall 2: Underestimating Heat and Noise. It's not an inconvenience; it's an engineering challenge. Failing to plan proper exhaust turns your mining room into a sauna, which will throttle your miner or kill it.

Pitfall 3: Going It Alone (Solo Mining). Unless you have a warehouse of hundreds of miners, solo mining Bitcoin is a lottery ticket with near-zero odds. You must join a mining pool to get consistent, small payouts.

Pitfall 4: Not Having a Financial Runway. Mining is a business with ongoing costs. If Bitcoin's price dips or difficulty spikes, you need to be able to cover months of electricity bills while operating at a loss, waiting for conditions to improve.

Your Burning Questions Answered

So, is building a Bitcoin mining rig worth it in 2024? For 95% of people, the answer is probably no. It's become a professional, capital-intensive industry with tight margins. The real value in going through this exercise isn't necessarily firing up a miner, but understanding the incredible infrastructure that secures the Bitcoin network. It's a fascinating world, but entering it as a small player is now more about passion and education than a get-rich-quick scheme.

If you have cheap, reliable power and a high tolerance for technical tinkering and noise, it can be a rewarding hobby that pays for itself—eventually. Just go in with your eyes wide open, a calculator in hand, and realistic expectations.

Leave A Comment