Best Crypto Mining Hardware: Ultimate ASIC & GPU Buyer's Guide

Advertisements

In This Guide

- The Great Divide: ASIC Miners vs. GPU Rigs

- Breaking Down the Top Crypto Mining Hardware Contenders

- Beyond the Machine: The Real Cost of Crypto Mining Hardware

- The Step-by-Step Reality: From Box to Mining

- Profitability: The Million-Dollar Question (Literally)

- Answering Your Burning Questions

- Final Thoughts: Is This for You?

Let's be honest. When you first start looking into crypto mining, the hardware landscape feels like a confusing jungle. One minute you're reading about someone making a fortune with a basement full of machines, the next you're seeing headlines about how mining is dead. The truth, as always, is stuck somewhere in the messy middle. I remember my own start a few years back, staring at a shopping cart filled with overpriced graphics cards, completely unsure if I was about to make a smart investment or a very expensive space heater. This guide is the one I wish I had back then.

We're going to cut through the hype and the fear. This isn't about getting rich quick. It's about understanding the tools of the trade—the actual crypto mining hardware—so you can make an informed decision. Whether you're a hobbyist curious about the tech or someone seriously evaluating a business venture, the core question remains the same: what should you actually buy, and why?

The Great Divide: ASIC Miners vs. GPU Rigs

This is the first and most critical fork in the road. Your entire strategy, budget, and potential profit hinge on this choice. It's the difference between buying a factory-built race car and building a versatile off-roader from parts.

ASIC Miners: The Specialized Powerhouses

ASIC stands for Application-Specific Integrated Circuit. Think of it as a one-trick pony, but a pony that does its one trick phenomenally well. An ASIC miner is built from the ground up to run a single mining algorithm, like Bitcoin's SHA-256. Nothing else. You can't use it to play games or render videos. It mines, and it does so with brutal efficiency.

The upside is raw power. The hash rate—the speed at which it can solve those math problems—is astronomically higher than a general-purpose computer. The downside is rigidity. If the cryptocurrency it mines becomes unprofitable or switches its algorithm (which some coins do to prevent ASIC dominance), your expensive machine turns into a very loud paperweight. I've seen it happen. A friend invested heavily in an ASIC for a smaller coin, only for the developers to change the rules and brick his hardware overnight. It was a tough lesson.

Major players like Bitmain (makers of the Antminer series) and MicroBT (Whatsminer) dominate this space. Their websites are the primary sources for new models, though stock and pricing can be volatile.

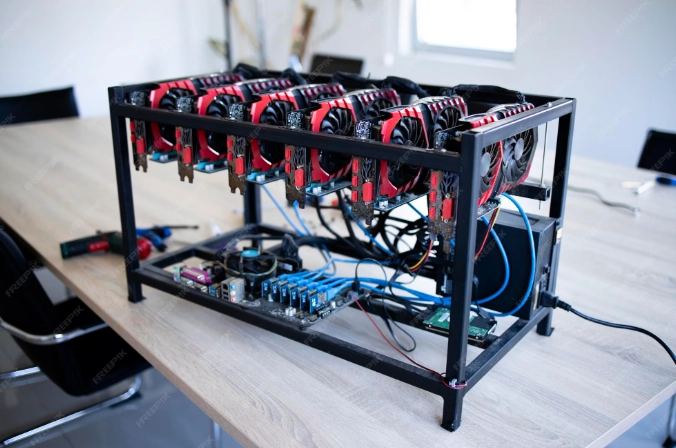

GPU Mining Rigs: The Flexible Workhorses

This is the classic image of mining: a metal frame bristling with glowing graphics cards (GPUs). These are the same cards you'd find in a gaming PC. Their strength is versatility. A GPU can mine hundreds of different cryptocurrencies based on algorithms like Ethash, KawPow, or Autolykos.

When one coin's profitability dips, you can simply point your rig at a different one. This flexibility is a huge risk mitigator. It also means the hardware has resale value; gamers are always looking for GPUs. The trade-off? Lower absolute efficiency for the specific task of mining compared to an ASIC. You're paying for that flexibility in higher power consumption per unit of work.

Building a rig is part of the fun for many. It's a hands-on project. You're sourcing the GPUs (historically from NVIDIA and AMD), a motherboard, a power supply, riser cables, and putting it all together. When Ethereum moved away from mining, it shook the entire GPU mining world, proving that even this model isn't future-proof.

Let's put them side-by-side. This table isn't about declaring a winner, but about showing the fundamental trade-offs.

| Feature | ASIC Miner | GPU Mining Rig |

|---|---|---|

| Primary Strength | Maximum hash rate & efficiency for one algorithm | Algorithm flexibility & multi-coin support |

| Best For | Mining established coins like Bitcoin (SHA-256), Litecoin (Scrypt) | Mining alternative coins (Altcoins), switching between projects |

| Noise & Heat | Extremely high. Sounds like a jet engine; needs serious cooling. | Moderate to high. Manageable with good airflow, but can heat a room. |

| Entry Cost | High. New units cost thousands of dollars. | Variable. Can start with 1-2 GPUs and scale. |

| Lifespan & Obsolescence Risk | High risk. Can be made obsolete by new models or protocol changes. | Lower risk. Hardware can be repurposed or sold. |

| Technical Skill Required | Low. Mostly plug-and-play after setup. | Medium to High. Requires assembly and software configuration. |

Breaking Down the Top Crypto Mining Hardware Contenders

Okay, you get the high-level choice. Now let's talk about specific machines. This isn't just a spec sheet review. I'm factoring in real-world stuff you only learn from experience: reliability, noise, where to actually buy them, and that gut feeling about a product.

Heavyweight ASIC Champions

The ASIC game is all about the latest generation. Efficiency, measured in joules per terahash (J/TH), is the god metric. A lower number means more hash power for less electricity, which is the difference between profit and loss.

- Bitmain Antminer S19 XP Hyd. This is the beast. When it launched, it reset expectations. We're talking about a 255 TH/s hash rate with an efficiency hovering around 20.8 J/TH. The "Hyd" means it uses immersion cooling, which is a whole other level. The price tag matches its performance—it's a serious capital investment. The noise? Forget about having it in any living space. This is for a dedicated shed, garage, or hosted facility.

- MicroBT Whatsminer M50S Bitmain's main rival, MicroBT, answers back with this model. It's incredibly competitive, offering similar efficiency benchmarks in the 22 J/TH range. Some miners swear by MicroBT's build quality and reliability. The competition between these two giants is great for driving innovation, but it also means today's top model can be overshadowed in a matter of months.

- Bitmain Antminer L7 (for Scrypt) Not all ASICs are for Bitcoin. The L7 dominates the Scrypt algorithm, which is used by Litecoin and Dogecoin. It's a reminder that the crypto mining hardware ecosystem has niches. If your interest is in those coins, this is essentially your only viable hardware option.

GPU Options: Navigating the Card Landscape

The GPU market has calmed down since the frenzy of 2021, but it's still nuanced. Efficiency, measured in megahash per second per watt (MH/s/W), is key here too. You're looking for the best performance for the least power draw.

Here’s a look at some workhorse cards, considering their mining performance on popular algorithms like Ethash (pre-merge) and others like Octopus or Autolykos that are still GPU-mineable.

| GPU Model | Memory Size | Approx. Mining Performance* | Key Consideration |

|---|---|---|---|

| NVIDIA GeForce RTX 3070 | 8GB GDDR6 | Excellent efficiency ratio | The sweet spot for many builders. Good balance of power and availability. |

| NVIDIA GeForce RTX 3060 Ti | 8GB GDDR6 | Similar to 3070, often better value | Frequently cited as one of the best "hash per dollar" cards historically. |

| AMD Radeon RX 6700 XT | 12GB GDDR6 | Strong on AMD-friendly algos | That 12GB buffer is a plus for some newer algorithms. |

| NVIDIA GeForce RTX 3080 | 10GB/12GB | High raw output | Power-hungry. Requires careful tuning and a strong PSU. |

*Performance varies wildly based on the specific coin, algorithm, and your overclock/undervolt settings. Sites like WhatToMine are essential for real-time comparisons.

A personal anecdote: I started with a single RTX 3060 Ti. The process of learning to undervolt it—reducing its power limit to save electricity while maintaining most of its hash rate—was more satisfying than I expected. It felt less like spending money and more like optimizing a system. That's the GPU rig appeal.

Beyond the Machine: The Real Cost of Crypto Mining Hardware

If you only budget for the hardware itself, you will fail. Full stop. The machine's price tag is just the entry fee. The ongoing operational costs are what make or break you.

Electricity: This is your nemesis and your most critical calculation. You need to know your cost per kilowatt-hour (kWh) down to the decimal. A machine drawing 3000 watts running 24/7 uses 72 kWh per day. At $0.12 per kWh, that's $8.64 per day, or over $315 per month just in electricity. An efficient machine might cut that by a third. Before you buy any crypto mining hardware, plug its power draw into a calculator with your electricity rate. There's no point mining $10 of coin while paying $15 for the power to do it.

Cooling & Ventilation: All this hardware turns electricity into heat. A lot of heat. That small room can hit 90°F (32°C) fast. You'll need fans, and possibly dedicated exhaust ducts, to move that heat outside. Otherwise, you're straining the hardware and possibly violating your home insurance policy. ASICs are worse; they often require dedicated forced-air ventilation.

Noise Pollution: This is the number one reason hobbyist miners get shut down by their family. An ASIC is louder than a vacuum cleaner running constantly. A rig with 6 GPUs has 6-12 fans whirring. It's a constant, droning sound. Can you put it in a basement where the sound is manageable? Do you have sound-dampening panels? This isn't a trivial concern.

Internet & Networking: You need a stable, always-on internet connection. Interruptions mean lost mining time. A wired Ethernet connection is vastly more reliable than Wi-Fi for your main rig.

The Step-by-Step Reality: From Box to Mining

Let's walk through what happens after your shiny new (or used) hardware arrives. This is where theory meets practice.

- Unboxing & Inspection: Check everything immediately. Look for physical damage, ensure all cables and components are present. For ASICs, the power supplies are often integrated, but check.

- Physical Setup:

- ASIC: Find its forever home. It needs open space, near a window or vent for exhaust, and on a stable, non-flammable surface. Connect the power cables (they're chunky). Connect the Ethernet cable.

- GPU Rig: Assemble the open-air frame. Install the motherboard, CPU, and RAM. Install the power supply. Attach the GPUs using riser cables. Cable management is crucial for airflow. It's like adult Legos with higher stakes.

- Software Configuration:

- ASIC: You'll access its built-in web interface. You type its IP address into a browser. Here, you point it to a mining pool (you didn't think you were mining solo, did you?) like Foundry USA Pool or Antpool, and enter your wallet address.

- GPU Rig: You'll install an operating system. Many use simple, mining-specific OSes like HiveOS or RaveOS. You flash it to a USB drive, boot from it, and configure it via a web dashboard. You add your "flight sheet"—which defines the pool, coin, and mining software (like T-Rex Miner for NVIDIA or TeamRedMiner for AMD).

- Tuning & Optimization: This is the secret sauce. Don't run hardware at stock settings. For GPUs, you'll use the OS dashboard to undervolt, set power limits, and overclock the memory. The goal is to lower the power draw while keeping the hash rate high. For ASICs, you might have different "profiles" (like low-power mode) to choose from. This tuning process can take days of testing for stability.

- Monitoring: Set up monitoring. Use the pool's website to see your worker's status. Use your rig's dashboard to see temperatures and fan speeds. Get alerts if a GPU goes offline or temperatures spike.

Profitability: The Million-Dollar Question (Literally)

"Is mining still profitable?" Everyone asks this. The answer is a frustrating "it depends." It's a dynamic equation with four main variables:

- Hardware Cost: Your initial investment.

- Hash Rate: Your machine's output.

- Power Consumption & Cost: Your ongoing expense.

- Cryptocurrency Price & Network Difficulty: The external factors you cannot control.

Network difficulty is the killer. As more people bring more crypto mining hardware online, the network automatically makes the math problems harder. This means your same machine earns less coin over time. It's a constant race. A machine that pays for itself in 12 months today might take 18 months if difficulty spikes.

You must use a profitability calculator. CryptoCompare and WhatToMine have good ones. Input your hardware's hash rate and power draw, your electricity cost, and it will give you a rough daily net profit estimate. Crucially, it shows you the "break-even" point.

My perspective? Viewing mining purely as a short-term profit machine leads to disappointment. The most resilient miners I know view it as a way to accumulate cryptocurrency they believe in long-term, while the hardware covers its own costs. They're buying the coin at the effective cost of their electricity, which can be below market price. This mindset change is everything.

Answering Your Burning Questions

Final Thoughts: Is This for You?

Choosing and using crypto mining hardware isn't a passive investment. It's a technical hobby with financial aspects. If you enjoy tinkering with hardware, optimizing systems, and learning about blockchain technology, you'll find immense satisfaction in it, even if the profits are modest. The community is full of helpful people.

If you're looking for a "set it and forget it" money printer, look elsewhere. The noise, heat, constant monitoring, and market volatility require active engagement.

Start small. Do the math—twice. Factor in all the hidden costs. Maybe begin with that single GPU in your existing PC. Learn the ecosystem. The worst thing you can do is order $10,000 worth of gear on a hype wave without understanding what you're getting into. The landscape of mining hardware is challenging, fascinating, and constantly changing. But with the right approach and realistic expectations, it can be a deeply rewarding way to engage with the crypto ecosystem. Good luck, and may your hash rate be high and your temps be low.

Leave A Comment